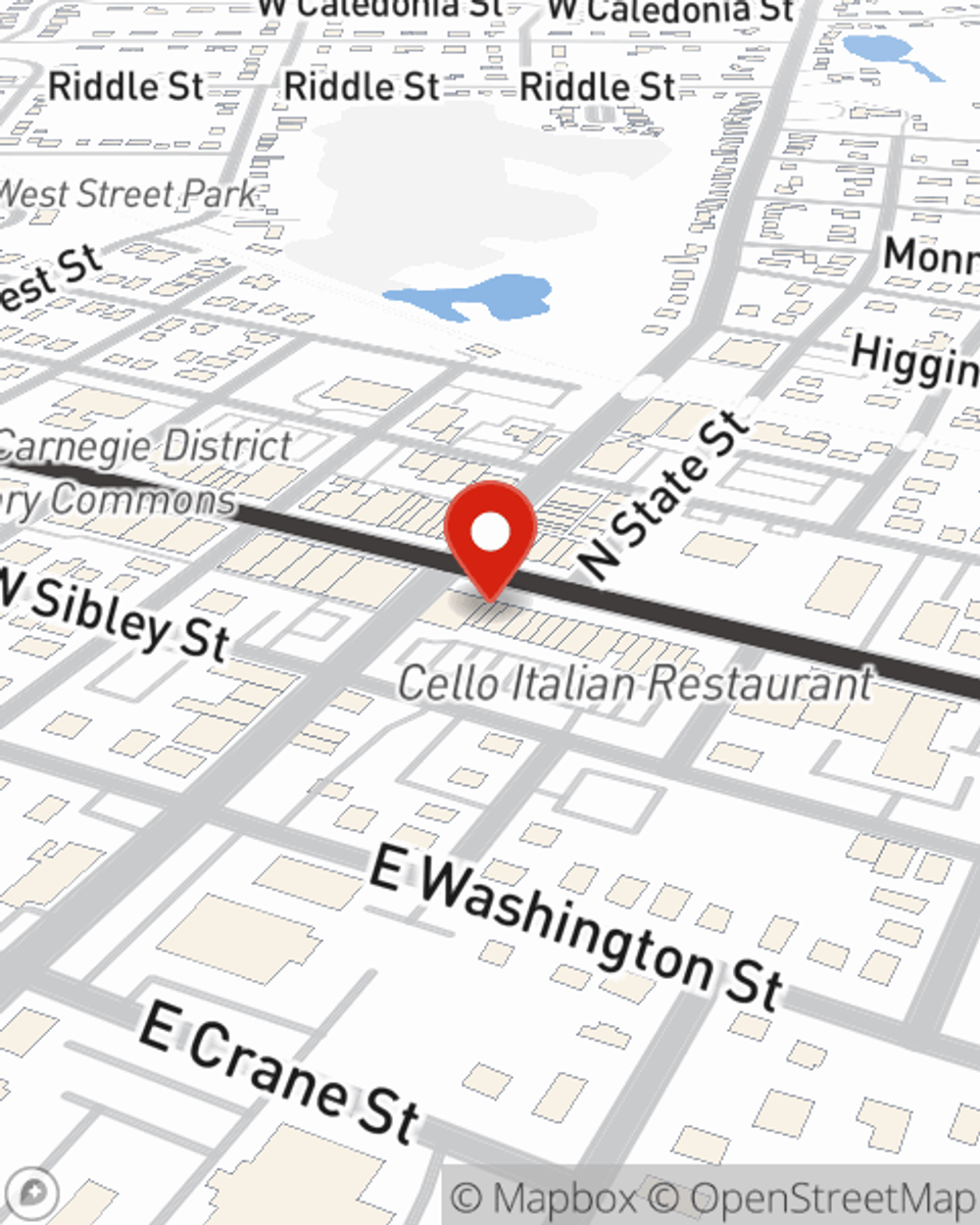

Business Insurance in and around Howell

Looking for coverage for your business? Look no further than State Farm agent Dan Kramer!

Cover all the bases for your small business

Coverage With State Farm Can Help Your Small Business.

When experiencing the wins and losses of small business ownership, let State Farm do what they do well and help provide great insurance for your business. Your policy can include options such as extra liability coverage, business continuity plans, and errors and omissions liability.

Looking for coverage for your business? Look no further than State Farm agent Dan Kramer!

Cover all the bases for your small business

Keep Your Business Secure

Whether you own a clock shop, a beauty salon or a floral shop, State Farm is here to help. Aside from outstanding service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Contact agent Dan Kramer to consider your small business coverage options today.

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Dan Kramer

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.